The complete guide to crowdfunding for eCommerce brands

Ash Read

September 9, 2022

Finance

As of 2021, crowdfunding efforts generated more than $1 billion. Predictions for 2022 estimate that those investments will double, which means your brand could miss out on big opportunities to grow if you ignore crowdfunding as a financing option.

Unfortunately, there’s no one-size-fits-all crowdfunding framework for eCommerce brands. But a good understanding of what crowdfunding is and how to maximize its benefits will allow you to create a successful crowdfunding campaign tailored to your company’s unique goals.

To get a complete understanding of crowdfunding for eCommerce, we spoke to three experts in the space. Throughout this guide, you’ll hear from:

- Andy Trewin Hutt, associate director at Morrama

- Jordan Stephanou, head of sales at Crowdcube

- Adam Woodhouse, COO of SPOKE

What is crowdfunding?

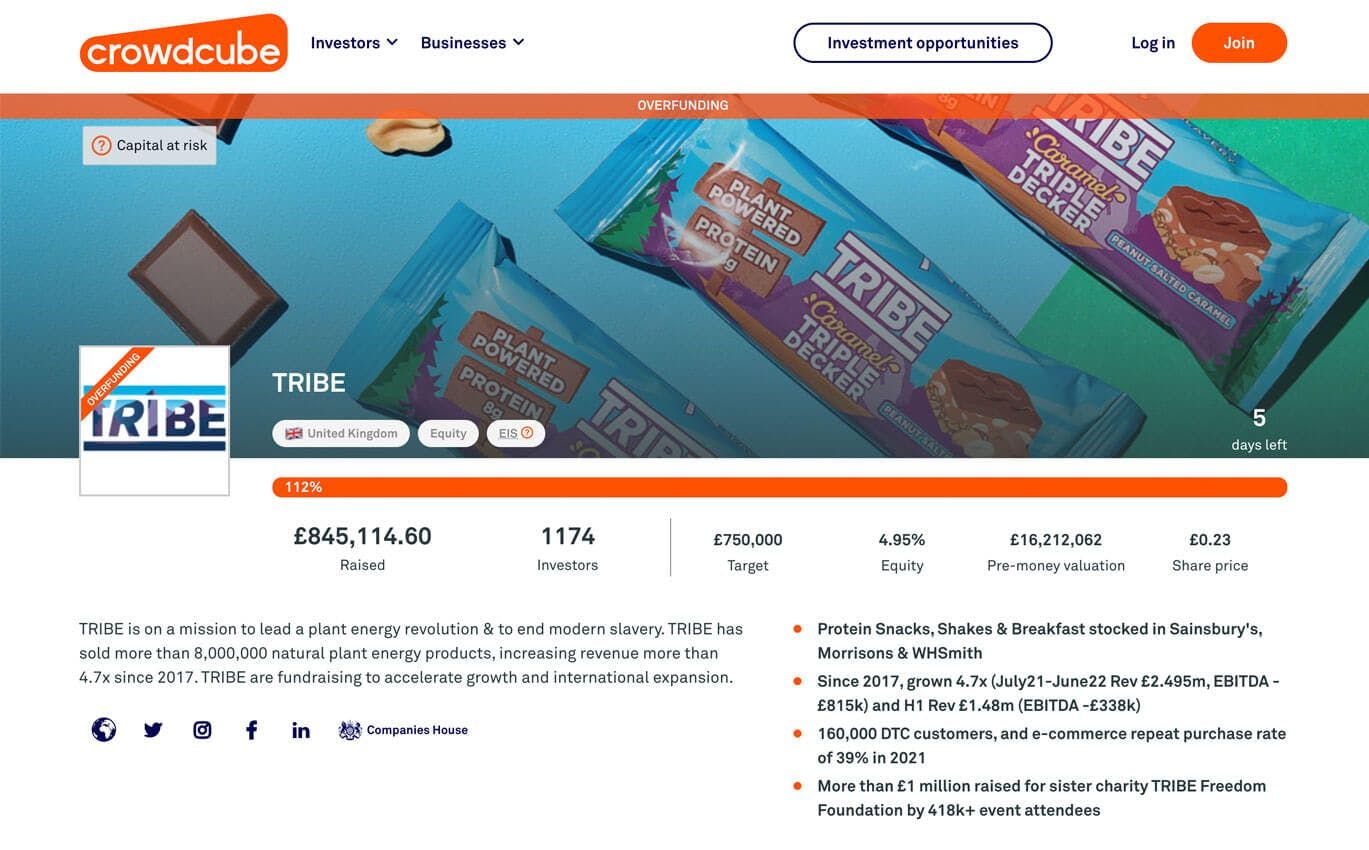

Crowdfunding is a financing method that businesses use to fund projects or scale growth by sourcing investment capital from an audience of investors. As Jordan Stephanou, Head of Sales at equity crowdfunding company Crowdcube, explains, “Large groups of people pool together individual investments to provide the money needed to get a company or project off the ground.”

Initially, crowdfunding was a way for founders to gauge interest in a business or project. But over the years, it’s evolved into a trusted way for those with business plans in hand or those who want their existing brand to grow to secure the funding they need to launch or scale.

Andy Trewin Hutt, associate director at Morrama, says that people who crowdfund today are “going out there to win, because you already intend on having a business.”

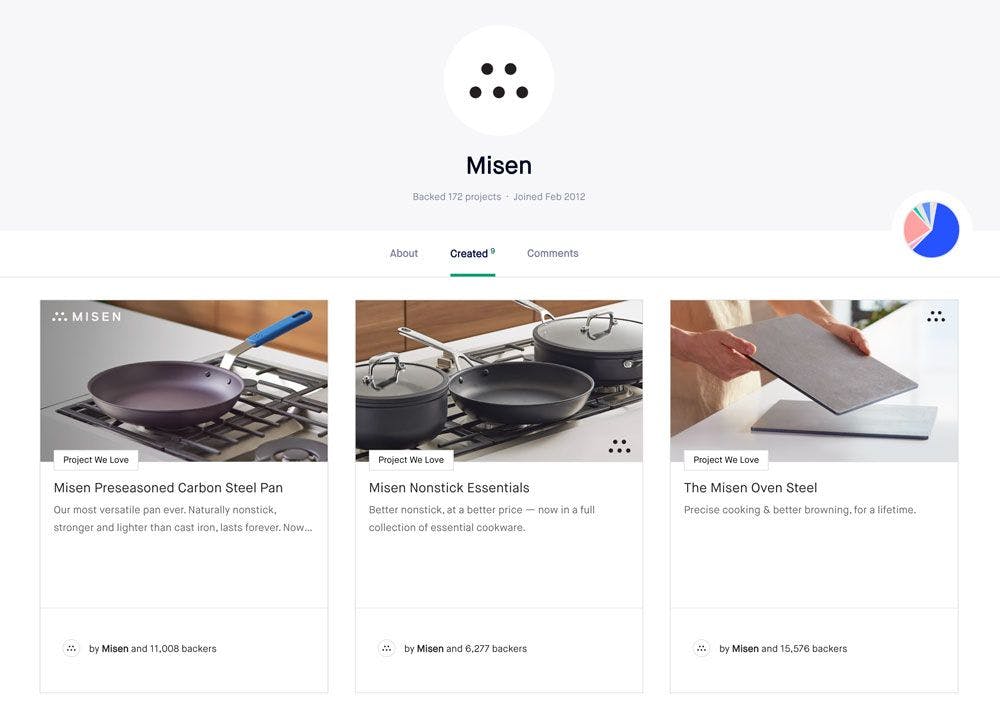

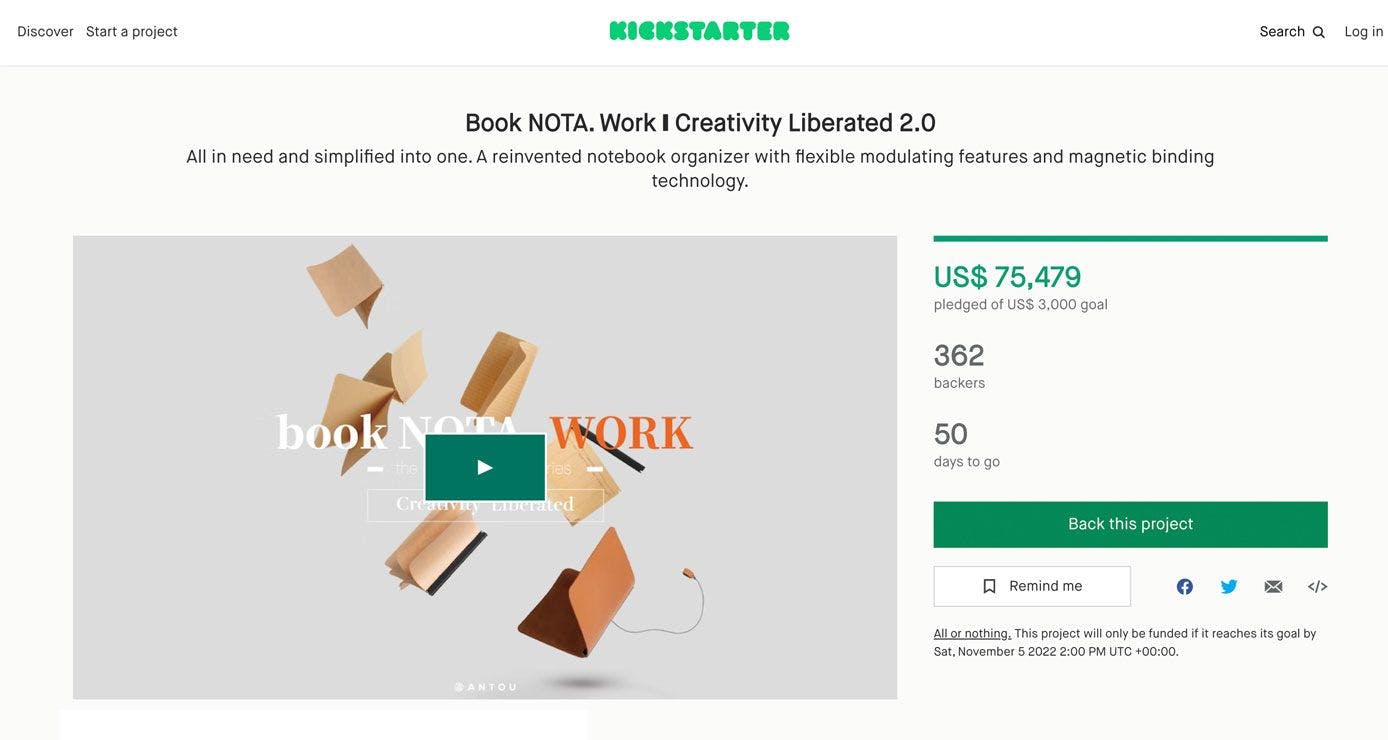

One of the most well-known and popular names in crowdfunding is Kickstarter, a platform that gained significant attention helping brands like Misen get off the ground and launch new products. Using Kickstarter, Misen has funded nine products and raised over $13 million.

The 2 types of crowdfunding for eCommerce

Businesses that plan to crowdsource capital need to be strategic with their efforts if they hope to convince individuals interested in their project to take the next step and invest. Investors want to feel confident that the money they give to a business isn’t going to be wasted on a poorly planned concept. But what motivates investors for one project won’t always drive investments in other projects.

The best crowdfunding campaigns customize their approach to their audience and target investors and goals. And while they often look very different from one another, generally, crowdfunding campaigns can be broken down into two types: equity and rewards based.

Equity-based crowdfunding

Equity-based crowdfunding refers to when individuals invest in an early-stage, private, or unlisted business in exchange for shares in the company. And according to Stephanou, an equity-based crowdfund “can positively impact your marketing and growth metrics. It’s a great method for building and engaging a community to drive your growth.”

Trading equity for funding gives investors a more personal level of connection to the project. And according to Hutt, that makes this type of fundraising ideal “for those kinds of higher-ticket items, which take longer to get a return on investment on.”

The individuals that invest in equity-based campaigns aren’t looking for an immediate return on their investment — they’re investing in a business because they believe in it. And they’ll want the brand to use their money for initiatives that support growth, like hiring an experienced COO to help scale operations. Stephanou explains:

“The benefits of an equity crowdfund go beyond capital. You get the backing of a community that comprises your most valued customers, avid fans, and biggest advocates, and running a crowdfund only strengthens these relationships. The businesses harnessing the power of their communities through co-ownership have a competitive edge that’s driving their long-term growth.”

“The benefits of an equity crowdfund go beyond capital. You get the backing of a community that comprises your most valued customers, avid fans, and biggest advocates, and running a crowdfund only strengthens these relationships."

Once they have a stake in your business, investors have a bigger incentive to support it. This means they’ll be more likely to help promote the brand, including referring the business to friends and family. And their personal tie to the business generally means their support won’t waver if the brand faces a hurdle.

Rewards-based crowdfunding

Revenue-based crowdfunding offers rewards to supporters who donate. And those rewards can be almost anything, from something small like a tote bag to something much more valuable, like a special collector’s edition release or discounted membership.

It is a great financing option for projects that aim to fund a product prototype and will need to drive sales to succeed. Besides funding, Stephanou explains that the value of rewards-based crowdfunding lies in getting “a steady client base and idea validation from the crowd.”

These types of crowdfunds also generate excitement by literally rewarding investors for their financial contributions. And the more excitement a project generates, the more likely investors will be to talk about it with their friends and online. This sets the official product launch up for greater success.

Once an entrepreneur or brand has had one successful project, they’ll be able to leverage that success with future projects. After a crowdfund ends, the highlights of the campaign will display on the fund organizer’s profile, which makes it easy for investors to see that a brand has a proven track record of success. The better a brand’s track record is, the more likely funders are to invest in future campaigns. This is why Hutt says you want to prove to investors that you’ve launched something “incredibly successful” on Kickstarter.

Why do eCommerce businesses choose to crowdfund?

Crowdfunding provides benefits that other types of traditional finance don’t, including the ability to implement campaigns and boost brand awareness quickly. Plus, unlike more traditional lending methods, whose repayment plans often influence business strategy, it allows brands to deploy capital when and how they want. Crowdfunding helps businesses plan strategically for the future Crowdfunding campaigns can act as a springboard for businesses to take products from development to product launch. And compared to other funding options like revenue-based finance, crowd-raised capital allows businesses to invest much more strategically.

Brands need to invest in things like market research and customer insights. And when a business enters a new stage, it often needs to grow its internal team by hiring experienced executives. Unfortunately, these investments take much longer to generate revenue, and their impact is much less tangible.

Adam Woodhouse, COO of SPOKE, says crowdfunding gives brands the capital they need to “invest in strategic initiatives that by definition probably have a high degree of value.”

Whereas loans and revenue-based financing options are typically used to fund short-term investments like marketing or inventory. According to Woodhouse, “You have to deploy the capital in places where you’ll bank the return on investment within the financing repayment window. So you put it in places where you have a robustly measurable return, like Facebook, like Google.”

With crowdfunding, you can look to use funds with a longer-term view.

Crowd engagement supports long-term success

A crowdfund doesn’t just help you raise capital, it helps to grow your audience by doubling down on current customers and making a big splash to attract new ones. Compared to other financing options, Woodhouse explains that “the attention [you get from a crowdfund] is a bit deeper and a bit broader than you get with a VC fundraise.”

Individuals that donate to or invest in your crowdfunding campaigns are also more likely to become engaged customers that want your brand to succeed. Brands are able to tell their entire story on the crowdfunding platform by writing a thorough description of the product, sharing photos, and posting videos. Hutt explains that this means investors “understand the business model. They understand where it’s being made, what it’s being made from, and then they buy it. So they feel invested in it.”

In SPOKE's case, these were some of the primary benefits that drove the decision to crowdfund. The brand was ready to grow and expand into the American market; it was time to invest in hiring, market research, and audience insights. Crowdfunding allowed SPOKE to do this by utilizing its established loyal customer base to promote the campaign and help drive awareness.

The result of the crowdfund was a genuine investment in the company. And according to Woodhouse, those investments extend beyond finance:

"We have people that are genuinely invested in the company. We can work with them to ask and answer a bunch of questions about what we should do, particularly on the product side of things,” he explained.

Building a crowdfunding campaign in 6 steps

A good crowdfunding campaign is an efficient method to raise capital. According to Woodhouse, SPOKE’s fundraising effort only took three and a half months, from the time the team first seriously considered a crowdfund until the campaign officially ended. But he admits, this is unusually fast, though not by much.

To see quick success, you need to invest time up front into your campaign. Most crowdfunding campaigns take closer to four months to plan, launch, and run to completion. Regardless, they’re incredibly fast ways to fundraise capital. And implementing one requires a well-thought-out campaign that considers the project’s end goal and uses tailored smart strategies to best help raise funds to meet those goals.

1. Establish a business plan

All crowdfunding campaigns aim to achieve a goal, and setting that goal is the first step in building a campaign. A good campaign will have an objective that is in alignment with the business’ overall goals, which means a solid business foundation is instrumental for a successful crowdfunding campaign. Hutt says, “[You] shouldn’t be designing stuff if [you] don’t have a business plan in place. So I would start with a business plan and then work out if design should be done, and then you can go from there.”

Once you have an established business plan, the first thing to consider when establishing an objective is the product or cause that you’re trying to fund. For example, a clothing company that wants to expand its offerings to include women’s clothing may need funding to manufacture a new line of clothing.

Identifying the driving force behind the campaign will help you uncover other factors that will inform the project’s objective, including what audience the crowdfund will target and what differentiates your product from competitors. For our clothing example, that would mean marketing to a new customer demographic and differentiating from the competition by focusing on factors like superior quality or more varied designs.

2. Set a funding target

Campaigns need to raise enough capital to achieve their goals, which means the project’s objective will directly impact the campaign’s funding target. To do this, Stephanou advises businesses to consider what he calls the “psychological drivers of fundraising.”

The fear of missing out, scarcity, and exclusivity are the primary revenue drivers for crowdfunds. And Stephanou explains that focusing on these psychological factors early can drive a successful campaign. They should also be a large consideration in setting a funding goal. Stephanou says:

“The goal should be low enough that the company is likely to hit the funding goal (100%) by the end of the first week or so, and overfund for the majority of the campaign, where scarcity and FOMO kick in.”

During its £4.7m crowdfunding campaign, SPOKE raised three times more capital from the crowd than its existing investors. To be successful, Woodhouse says brands should “Try and be clear about the split of the funding that’s coming from your existing institutional investors and how much will come from the crowd.”

When you see a campaign launch and almost instantly hit its funding target, much of that investment tends to come from institutional investors lined up to invest before the campaign go-live.

3. Craft a strong pitch

To convince people to invest in your crowdfund, you need to convince them that your project is worth supporting. And that requires a pitch, which will tell your business story and explain the value of your project. According to Woodhouse, the content of your pitch is “remarkably similar” to the content you would use for a venture capital raise.

A strong pitch will include critical information about the project, including the problem it solves, the market you plan to introduce it in, and what the competition looks like. It will also include more granular details about the business, like financial projections and which KPIs you’ll use to gauge success.

It’s also important to consider who the target audience of the fund is to ensure the pitch addresses their own priorities and uses language they’ll connect with. SPOKE, for instance, had potential investors ask to see detailed financial information to feel confident about their investment.

4. Conduct research and compile assets

A good campaign launch generates a lot of attention from funders and can quickly earn high levels of investment. A fast start is almost always vital for the campaign's overall success. To achieve this, you’ll need to capture investors’ attention as early as possible, which means preparing early and letting them know about the crowdfund before its launch. Stephanou says:

“Getting a crowdfunding campaign off to a good start is vital to its success. It’s important to research and engage potential lead investors (within or outside of the company’s own network) early on to ensure they build momentum right from the start of their campaign.”

Collect data from prior marketing campaigns and gather insights about your audience. Then, compile email lists, video assets, copy assets, Gantt charts, and any other assets you’ll need to access throughout your campaign. Organize and store them all in the same place for convenient access.

5. Define communication channels

To set your campaign up for success, you need to prepare and be clear about your plans. Assess who your target audience is and determine what the best channels to communicate with them are. Focus on prior marketing campaigns and what has been successful. Then, take the same approach to promote your crowdfund. Stephanou’s advice to brands is to “keep it simple, and focus your time and effort on the things you know work well for your business.”

Stephanou says brands should also incorporate a few other promotional strategies into their marketing efforts:

- Email, which he says “has proven to be the most effective channel for driving traffic, and most importantly, investment.”

- Generating referral traffic from the brand website, “can help turn your customers and advocates into investors.”

- Strategically using social media to help promote your raise to a broader audience.

6. Support the campaign post-launch

Before they invest, funders will have questions about your business and your project. And you need to be ready to answer. According to Woodhouse, responding to questions quickly with full and complete answers is “confidence-inspiring,” which increases the chances that investors will support your project.

Woodhouse also recommends that you nominate at least one person to take responsibility for answering questions. This will likely be a full-time job for at least one or two people in the first few days after the campaign launch. And someone will need to continue to dedicate around half of their time to fielding questions until the campaign ends.

You should also continue to promote the raise throughout the duration of your campaign. Stephanou says, “it’s worth planning in a series of posts to coincide with key milestones in your crowdfunding campaign.”

Maximize crowdfunding ROI with financial planning

When you successfully raise a round of investment through crowdfunding (or raising more traditionally from Angels and VCs), you need to think strategically about where that money is deployed.

You don’t want to spend all your newly raised cash on short-term growth initiatives like buying inventory and funding marketing campaigns. Equity funding is better spent in ways that aid long-term growth.

For SPOKE, the crowdfunding money enabled them to focus more on their U.S. expansion. “We care greatly about breaking the U.S. market,” Woodhouse says. “We're growing 100 percent year-on-year.”

Due to the sheer size of the U.S. market, SPOKE has a lot of work to do to fully establish itself as a major player in the menswear space, and the funds raised through its crowdfunding round gave the brand the resources it needed to lay the foundation for future growth in this market.

“There are a bunch of things [we’re doing] like hiring a U.S. General Manager, building out some specific US market knowledge, and focusing on customer insights and research,” says Woodhouse. These are important strategic investments for the long-term growth of the business. “We’re now in a stronger place to deploy capital towards those investments, which is what we always hoped the equity financing would allow us to do,” adds Woodhouse.

But businesses that don’t supplement cash flows with other finance are missing opportunities to maximize the impact of crowdfunding efforts.

For a high-growth eCommerce business, you must pull levers that drive short-term growth alongside your long-term bets — things like buying enough inventory to avoid stockouts and investing in marketing campaigns. For these types of initiatives, SPOKE turned to revenue-based finance.

“Revenue-based finance definitely helped us spend money with confidence in a way that we probably wouldn't have otherwise,” says Woodhouse.

With funding from Wayflyer, SPOKE was able to invest in marketing channels where they were already seeing predictable returns, like Google and Facebook ads. The funding enabled SPOKE to acquire 30,000 new customers without diverting too much of its equity investment toward its marketing campaigns.

Book a call with us to explore your options and see how revenue-based financing can help support your growth.